First-Quarter Revenue Growth Accelerates to 110% on GMV Growth of 114% Year on Year

Shopify reports in U.S. dollars and in accordance with U.S. GAAP

Internet, Everywhere - April 28, 2021 - Shopify Inc. (NYSE:SHOP)(TSX:SHOP), a leading global commerce company, announced today strong financial results for the quarter ended March 31, 2021.

“More entrepreneurs around the world are choosing Shopify to launch and grow their businesses, and for good reason,” said Harley Finkelstein, Shopify’s President. “Our singular focus is on making entrepreneurship easier, and making it easier for entrepreneurs to succeed. Merchant sales growth on our platform accelerated in the first quarter as merchants leveraged our modern commerce technology, which helps them compete in any retail environment and engage directly with their customers wherever they are.”

“Shopify’s momentum continued into 2021 as digital commerce tailwinds remained strong and merchants took advantage of the range of capabilities offered by our platform,” said Amy Shapero, Shopify’s CFO. “We are focused on building a commerce operating system that will help shape the future of retail. Our merchant-first business model positions us to capture the massive opportunity presented by the growth of digital commerce, benefiting both our merchants and Shopify.”

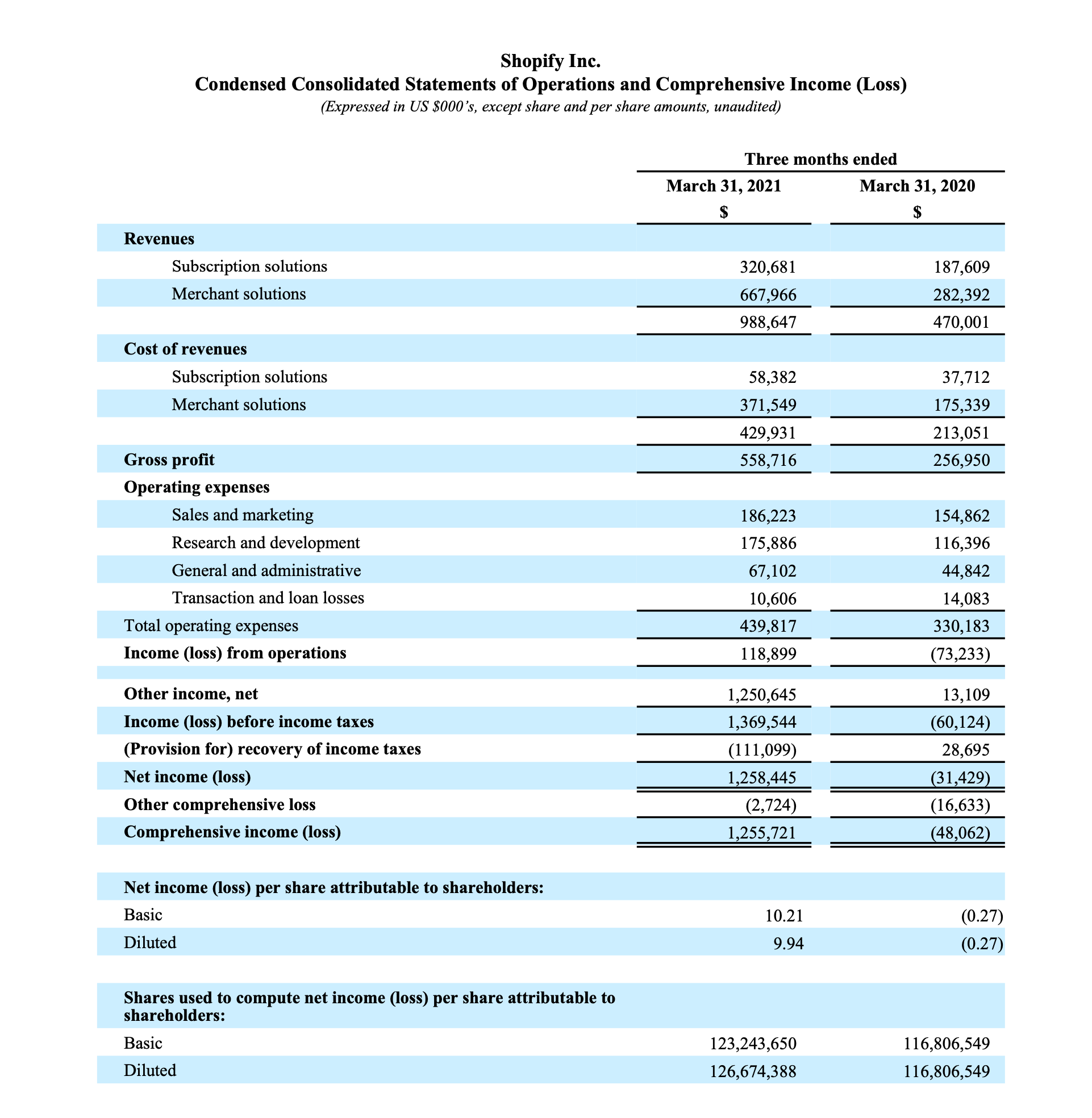

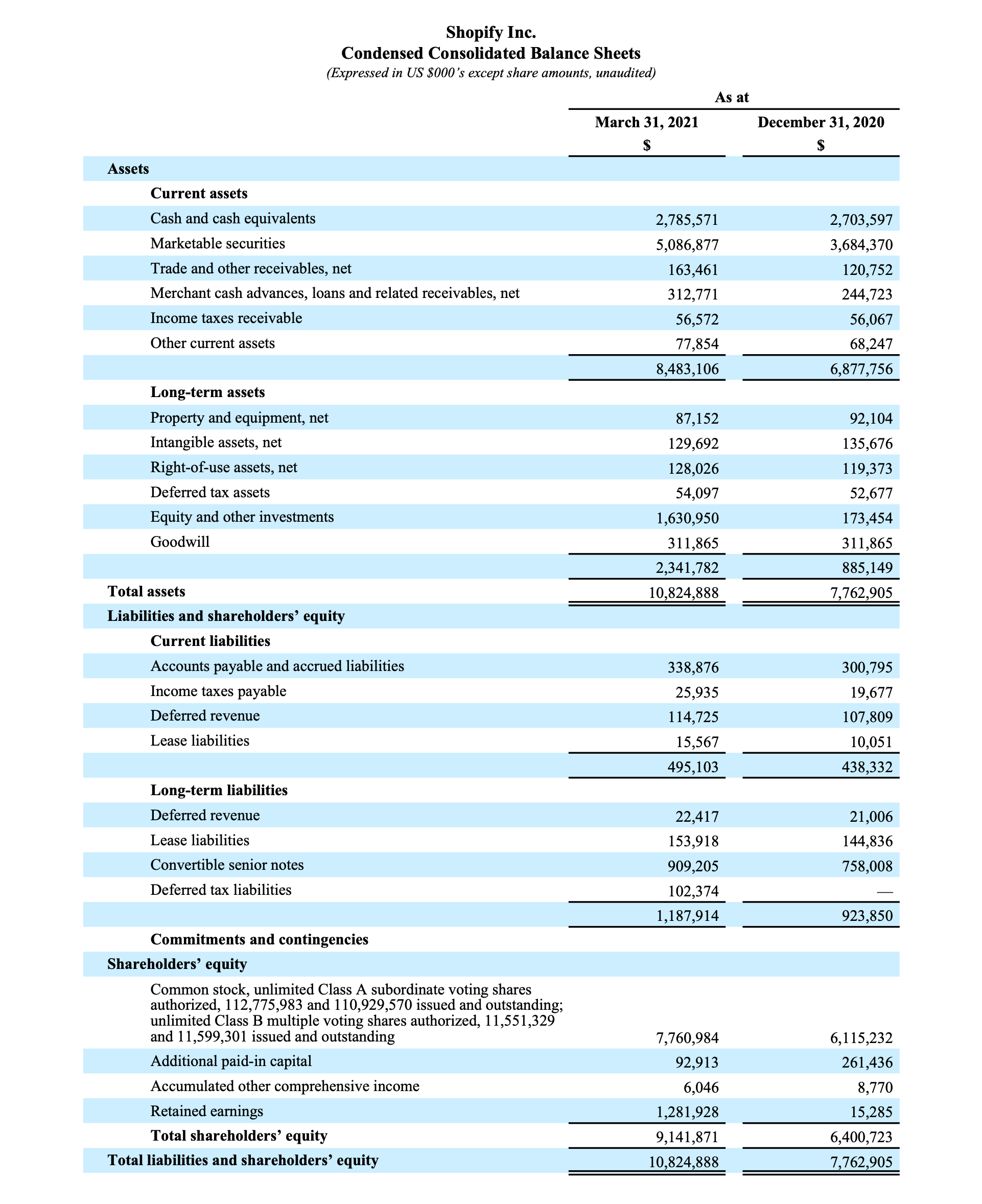

First-Quarter Financial Highlights

- Total revenue in the first quarter was $988.6 million, with growth accelerating to 110% year over year.

- Subscription Solutions revenue was $320.7 million, with growth accelerating to 71% year over year, primarily due to more merchants joining the platform.

- Merchant Solutions revenue was $668.0 million, with growth accelerating to 137%, driven primarily by the growth of Gross Merchandise Volume1 ("GMV").

- Monthly Recurring Revenue2 ("MRR") as of March 31, 2021 was $89.9 million. Growth accelerated to 62% year-over-year with MRR up from $55.4 million as of March 31, 2020 as more merchants joined the platform and POS Pro contributed its first full quarter of revenue. Shopify Plus contributed $23.1 million, or 26%, of MRR compared with 28% of MRR as of March 31, 2020 as a result of the significantly higher number of merchants on standard plans joining the platform in the past 12 months and our first full quarter of revenue from our Retail POS Pro subscription offering.

- GMV for the first quarter was $37.3 billion, an increase of $19.9 billion, with growth accelerating to 114% over the first quarter of 2020. Gross Payments Volume3 ("GPV") grew to $17.3 billion, which accounted for 46% of GMV processed in the quarter, versus $7.3 billion, or 42%, for the first quarter of 2020.

- Gross profit dollar growth accelerated, up 117% to $558.7 million in the first quarter of 2021, compared with $257.0 million for the first quarter of 2020.

- Adjusted gross profit4 growth accelerated, up 114% to $565.1 million in the first quarter of 2021, compared with $263.8 million for the first quarter of 2020.

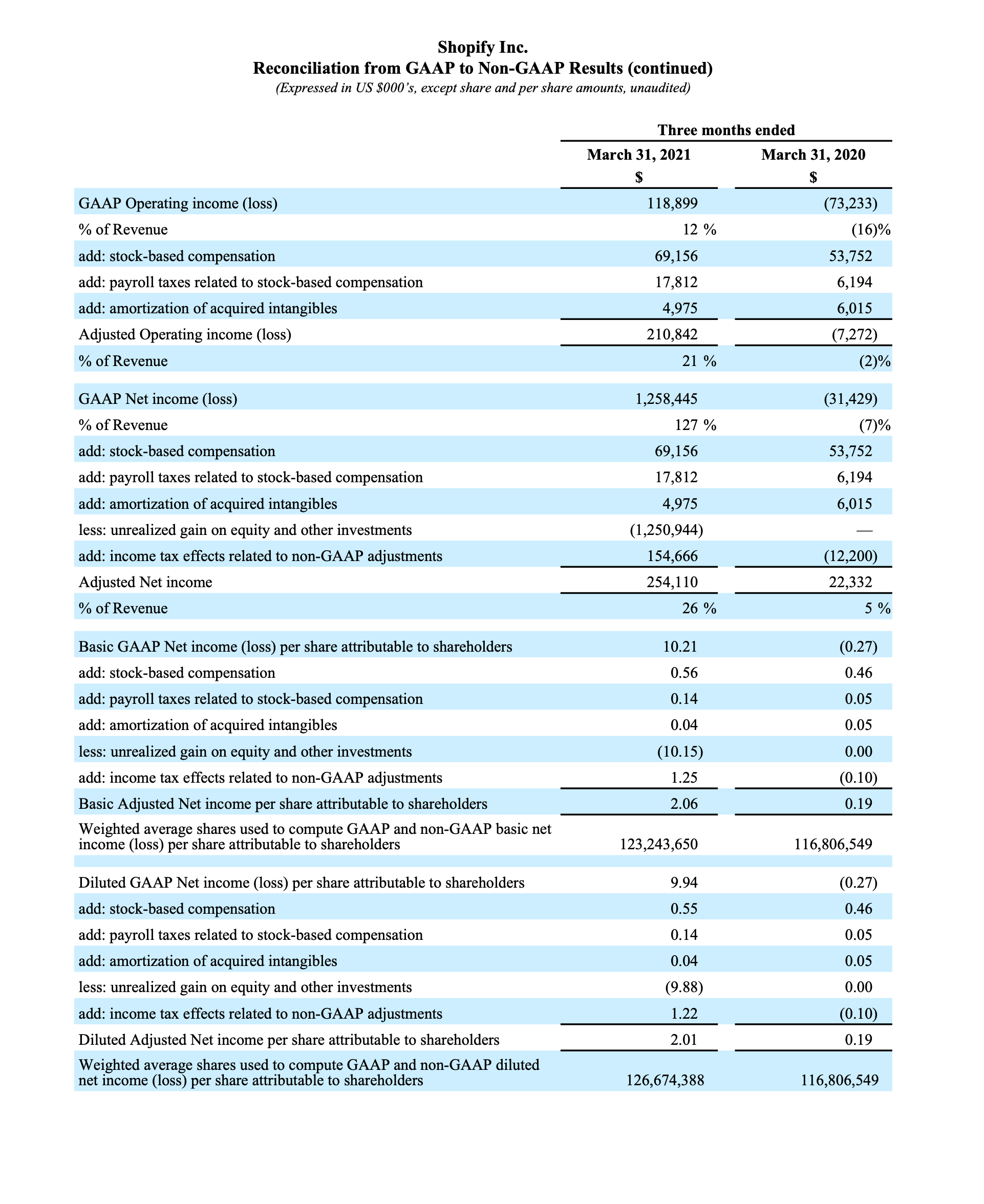

- Operating income for the first quarter of 2021 was $118.9 million, or 12% of revenue, versus a loss of $73.2 million, or 16% of revenue, for the comparable period a year ago.

- Adjusted operating income4 for the first quarter of 2021 was $210.8 million, or 21% of revenue, compared with adjusted operating loss of $7.3 million or 2% of revenue in the first quarter of 2020.

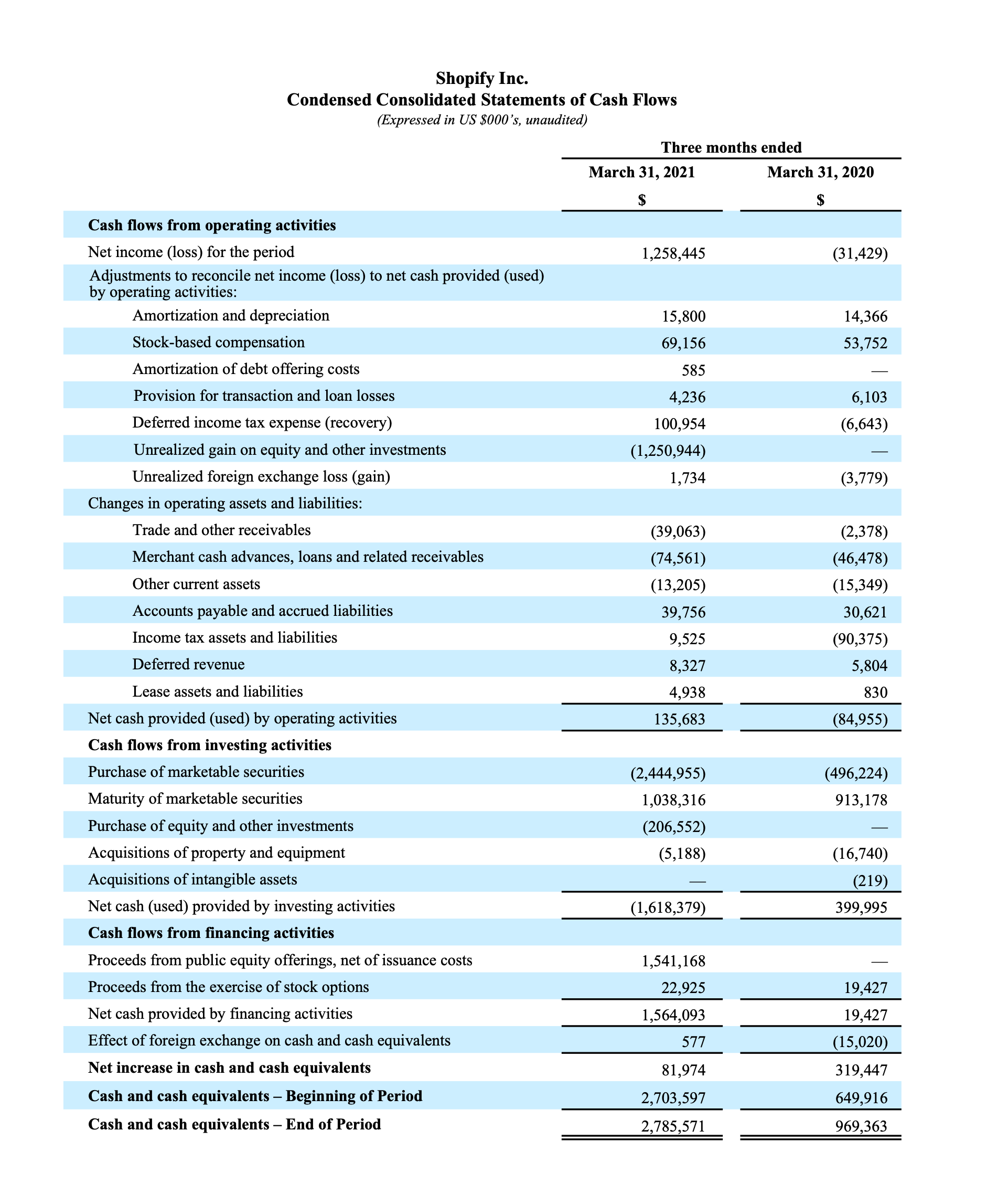

- Net income for the first quarter of 2021 was $1,258.4 million, or $9.94 per diluted share, compared with a net loss of $31.4 million, or $0.27 per diluted share, for the first quarter of 2020. Q1 2021 net income includes a $1.3 billion unrealized gain on our equity investment in Affirm as a result of its IPO in January 2021.

- Adjusted net income4 for the first quarter of 2021 was $254.1 million, or $2.01 per diluted share, compared with adjusted net income of $22.3 million, or $0.19 per diluted share, for the first quarter of 2020.

- At March 31, 2021, Shopify had $7.87 billion in cash, cash equivalents and marketable securities, compared with $6.39 billion on December 31, 2020. The increase reflects $1.5 billion of net proceeds from Shopify’s offering of Class A subordinate voting shares in the first quarter of 2021.

First-Quarter Business Highlights

- Shopify continued to build the foundation of Shopify Fulfillment Network, focusing on optimizing our software and network, and introduced features that offer merchants greater insights into their inventory and increased flexibility to manage their orders.

- Shopify continued to develop Shop, our all-in-one mobile shopping assistant, reducing friction for buyers with the introduction of an in-app buy button and adding more ways that merchants can be discovered, including filters to find Asian-owned businesses, women-owned businesses in March, and merchants practicing and promoting sustainable commerce. At the end of Q1 2021, Shop had more than 107 million registered users, including buyers using Shop Pay as well as the Shop App, of which more than 24 million were Monthly Active Users. At the end of March 2021, Shop Pay had facilitated over $24 billion in cumulative GMV since its launch in 2017.

- Shopify announced that it had purchased more Direct Air Capture (DAC) carbon removal than any other company in history. This milestone came with our agreement to purchase 10,000 tonnes of removal from Carbon Engineering, adding to a previous 5,000-tonne commitment to Climeworks. The goal of Shopify's Sustainability Fund is to engineer market forces to get momentum behind new technologies that at scale could have a material impact on tackling climate change, and the Fund earmarks $1 million or more per year specifically for carbon sequestration.

- Shopify released the documentary, “Own the Room”, co-produced with Saville Productions for National Geographic Documentary Films, which premiered on Disney Plus in March. Own the Room showcases the real stories of five young entrepreneurs as they compete in the prestigious Global Student Entrepreneur Awards.

- Merchants in the U.S., Canada, and the U.K. received a record $308.6 million in merchant cash advances and loans from Shopify Capital in the first quarter of 2021, an increase of 90% versus the $162.4 million received by U.S. merchants in the first quarter of last year. Shopify Capital has grown to approximately $2.0 billion in cumulative capital advanced since its launch in April 2016, approximately $312.8 million of which was outstanding on March 31, 2021.

- Shopify’s partner ecosystem continued to expand, as approximately 45,800 partners referred a merchant to Shopify over the past 12 months, up 73% compared with 26,400 over the 12 months ended March 31, 2020.

Subsequent to First Quarter 2021

- Shopify introduced a new integrated card reader using our All-New POS software in the U.K. and Ireland, strengthening our Shopify POS offering to merchants in these regions and laying the groundwork to put Shopify POS with integrated payments into the hands of new and existing merchants worldwide.

- Shopify published its 2020 Global Economic Impact Report showcasing Shopify as a platform that drives substantial business growth and expansion for entrepreneurs and economies around the world. In 2020, businesses on Shopify generated over $307 billion in global economic impact, supporting over three million jobs worldwide. In addition, our partner ecosystem generated $12.5 billion in revenue as our merchants’ selling drove massive volumes of economic activity.

Outlook

The outlook that follows constitutes forward-looking information within the meaning of applicable securities laws and is based on a number of assumptions and subject to a number of risks. Actual results could vary materially as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control. Please see "Forward-looking Statements" below.

In addition to the other assumptions and factors described in this press release, Shopify’s outlook assumes the continuation of growth trends in our industry, our ability to manage our growth effectively, the absence of material changes in our industry or the global economy and other assumptions related to the COVID-19 pandemic, which are described in detail below. The following statements supersede all prior statements made by Shopify and are based on current expectations. As these statements are forward-looking, actual results may differ materially.

These statements do not give effect to the potential impact of mergers, acquisitions, divestitures or business combinations that may be announced or closed after the date hereof. All numbers provided in this section are approximate.

Our full-year 2021 outlook is guided by assumptions that remain unchanged from February: that as countries continue to roll out vaccines in 2021 and populations are able to move about more freely, the overall economic environment will likely improve; some consumer spending will likely rotate back to offline retail and services; and the ongoing shift to ecommerce, which accelerated in 2020, will likely resume a more normalized pace of growth.

In March 2021, the US government passed a coronavirus relief package, and began processing stimulus payments in early March. The benefit to Shopify’s GMV from this latest round of stimulus ended in early April.

In view of these factors, we continue to expect to grow revenue rapidly in 2021, but at a lower rate than in 2020. For the full year 2021, we continue to expect the following:

- Subscriptions solutions revenue growth to be driven by more merchants around the world joining the platform in a number lower than the record in 2020, but higher than any year prior to 2020;

- The growth rates of subscription solutions and merchant solutions revenues to be more similar to each other than in the recent past, as we do not expect the surge in GMV that drove merchant solutions in 2020 to repeat;

- Merchant solutions revenue growth to be driven by continued GMV growth from existing merchants, new merchants joining the platform, and expanded adoption of Shopify’s growing menu of merchant solutions, including established offerings such as Shopify Payments, Shopify Shipping, and Shopify Capital, both geographically and as merchants grow into them, while newer solutions such as Shopify Fulfillment Network and 6 River Systems contribute nascent but incremental revenue in their early stages.

While we expect that the first quarter will likely still contribute the smallest share of full-year revenue and the fourth quarter the largest, the revenue spread may be more evenly distributed across the four quarters than it has been historically if the rollout of a vaccine shifts more consumer spending to services and offline shopping towards the back half of the year.

2020 catapulted commerce into a period of incredibly rapid change, presenting Shopify with unprecedented opportunities in 2021 to accelerate innovation. We continue to expect rapid growth in gross profit dollars in 2021 and plan to reinvest back into our business as aggressively as we can, with the year-over-year growth in operating expenses accelerating each quarter throughout the rest of the year. As such, we expect full year 2021 adjusted operating income to be below the level we achieved in 2020.

For 2021, we now anticipate stock-based compensation expenses and related payroll taxes of $425 million and amortization of acquired intangibles of $21 million.

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss our first-quarter results today, April 28, 2021, at 8:30 a.m. ET. The conference call will be webcast on the investor relations section of Shopify’s website at https://investors.shopify.com/news-and-events/. An archived replay of the webcast will be available following the conclusion of the call.

Shopify’s First Quarter 2021 Interim Unaudited Condensed Consolidated Financial Statements and Notes and its First Quarter 2021 Management's Discussion and Analysis are available on Shopify’s website at www.shopify.com and will be filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

About Shopify

Shopify is a leading global commerce company, providing trusted tools to start, grow, market, and manage a retail business of any size. Shopify makes commerce better for everyone with a platform and services that are engineered for reliability, while delivering a better shopping experience for consumers everywhere. Proudly founded in Ottawa, Shopify powers over 1.7 million businesses in more than 175 countries and is trusted by brands such as Allbirds, Gymshark, Heinz, Staples Canada, and many more. For more information, visit www.shopify.com.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with United States generally accepted accounting principles ("GAAP"), Shopify uses certain non-GAAP financial measures to provide additional information in order to assist investors in understanding our financial and operating performance.

Adjusted gross profit, adjusted operating income, non-GAAP operating expenses, adjusted net income and adjusted net income per share are non-GAAP financial measures that exclude the effect of stock-based compensation expenses and related payroll taxes and amortization of acquired intangibles. Adjusted net income and adjusted net income per share also exclude unrealized gains on equity and other investments and tax effects related to non-GAAP adjustments.

Management uses non-GAAP financial measures internally for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Shopify believes that these non-GAAP measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. Non-GAAP financial measures are not recognized measures for financial statement presentation under U.S. GAAP and do not have standardized meanings, and may not be comparable to similar measures presented by other public companies. Such non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. See the financial tables below for a reconciliation of the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of applicable securities laws, including statements regarding Shopify’s planned business initiatives and operations and outlook, the performance of Shopify's merchants, the impact of Shopify's business on its merchants and other entrepreneurs, and economic activity and consumer spending. Words such as “believe”, "continue", "will", “plan”, “anticipate”, and "expect" or similar expressions are intended to identify forward-looking statements.

These forward-looking statements are based on Shopify’s current projections and expectations about future events and financial trends that management believes might affect its financial condition, results of operations, business strategy and financial needs, and on certain assumptions and analysis made by Shopify in light of the experience and perception of historical trends, current conditions and expected future developments and other factors management believes are appropriate. These projections, expectations, assumptions and analyses are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause actual results, performance, events and achievements to differ materially from those anticipated in these forward-looking statements. Although Shopify believes that the assumptions underlying these forward-looking statements are reasonable, they may prove to be incorrect, and readers cannot be assured that actual results will be consistent with these forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control, including but not limited to: (i) merchant acquisition and retention; (ii) managing our growth; (iii) our potential inability to compete successfully against current and future competitors; (iv) the security of personal information we store relating to merchants and their customers and consumers with whom we have a direct relationship; (v) our history of losses and our ability to maintain profitability; (vi) a disruption of service or security breach; (vii) our limited operating history in new markets and geographic regions; (viii) our ability to innovate; (ix) international sales and operations and the use of our platform in various countries; (x) our reliance on a single supplier to provide the technology we offer through Shopify Payments; (xi) our potential inability to hire, retain and motivate qualified personnel; (xii) our use of a single cloud-based platform to deliver our services; (xiii) uncertainty around the duration and scope of the COVID-19 pandemic and the impact of the pandemic and actions taken in response on global and regional economies and economic activity; (xiv) the reliance of our growth in part on the success of our strategic relationships with third parties; (xv) complex and changing laws and regulations worldwide; (xvi) our dependence on the continued services of management and other key employees; (xvii) our potential failure to effectively maintain, promote and enhance our brand; (xviii) payments processed through Shopify Payments; (xix) serious errors or defects in our software or hardware or issues with our hardware supply chain; (xx) our potential inability to achieve or maintain data transmission capacity; (xxi) activities of merchants or partners or the contents of merchants’ shops; (xxii) evolving privacy laws and regulations, cross-border data transfer restrictions, data localization requirements and other domestic or foreign regulations may limit the use and adoption of our services; (xxiii) changes in tax laws or adverse outcomes related to our taxes; (xiv) other one-time events and other important factors disclosed previously and from time to time in Shopify’s filings with the U.S. Securities and Exchange Commission and the securities commissions or similar securities regulatory authorities in each of the provinces or territories of Canada. The forward-looking statements contained in this news release represent Shopify’s expectations as of the date of this news release, or as of the date they are otherwise stated to be made, and subsequent events may cause these expectations to change. Shopify undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

1. Gross Merchandise Volume, or GMV, represents the total dollar value of orders facilitated through the Shopify platform including certain apps and channels for which a revenue-sharing arrangement is in place in the period, net of refunds, and inclusive of shipping and handling, duty and value-added taxes.

2. Monthly Recurring Revenue, or MRR, is calculated by multiplying the number of merchants by the average monthly subscription plan fee in effect on the last day of that period and is used by management as a directional indicator of subscription solutions revenue going forward assuming merchants maintain their subscription plan the following month.

3. Gross Payments Volume, or GPV, is the amount of GMV processed through Shopify Payments.

4. Non-GAAP financial measures exclude the effect of stock-based compensation expenses and related payroll taxes, amortization of acquired intangibles, unrealized gains on equity and other investments, and tax effects related to non-GAAP adjustments. Please refer to "Non-GAAP Financial Measures" in this press release for more information.

Shopify Announces First-Quarter 2021 Financial Results.pdf